Personal Banking

Tools and Resources

Partner Services

Personal Banking

Tools and Resources

Partner Services

Personalized Investing

Expert advice to reach your financial goals.

Wealth Management

For more complex financial planning needs.

Do-It-Yourself Investing

Tools and Resources

Investing Rates

Mortgage Rates

Daily Banking Rates

Loan Rates

About Kindred

Community Engagement

Open an Account Online

Apply for a Loan Online

Why Kindred?

Book an appointment with a Kindred staff member about...

Borrowing / Lending

Investing / Financial Advice

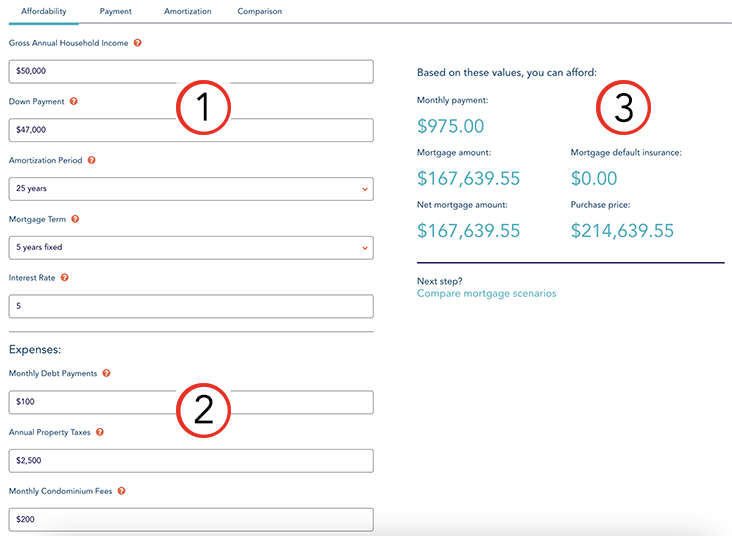

Gross Annual Household Income: Your total income from wages or other sources of primary income before taxes. If you are married or common law, this is your total combined gross annual income.

Down Payment: The amount you pay up front for your mortgage. You’re typically required to pay at least 5% of the total purchase price.

Amortization Period: The number of months or years over which the mortgage is repaid. The maximum amortization period is 35 years.

Mortgage Term: The length of the mortgage contract, which can be tied to a specific interest rate.

Interest Rate: The annual interest rate on your mortgage.

The Mortgage Affordability Calculator helps you to determine how much you can borrow.

You’re able to view your payments in a graph or as a report. You can also print or save your results.

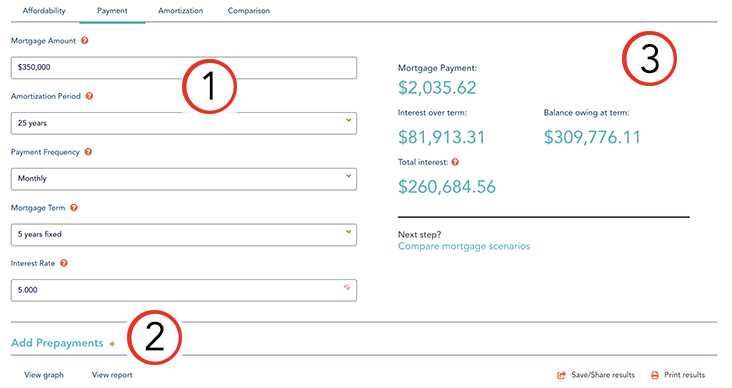

The Mortgage Payment Calculator estimates the amount of your mortgage payment and generates an amortization schedule for payments.

You’re able to view your payments in a graph and as a report. You can also print or save your results.

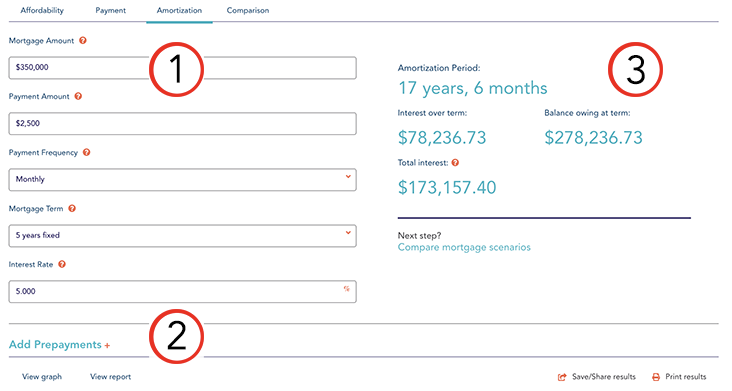

The Mortgage Amortization Calculator shows how long it will take to pay off your mortgage.

You’re able to view your payments in a graph and as a report. You can also print or save your results.

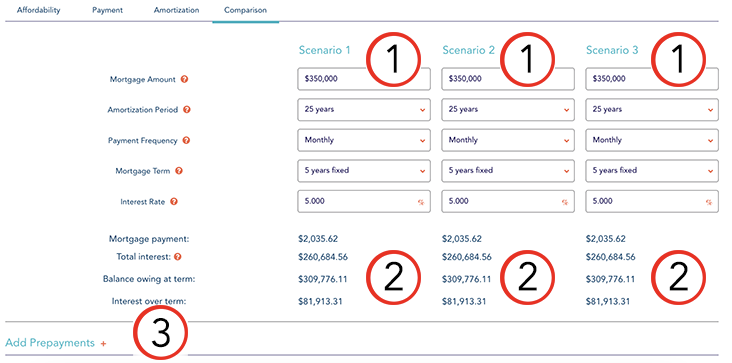

The Mortgage Comparison Calculator establishes which mortgage product might be right for you.

You’re able to view your payments in a graph and as a report. You can also print or save your results.

© 2026 Kindred Credit Union. All rights reserved. Inspiring peaceful, just, and prosperous communities